Mileagewise - Reconstructing Mileage Logs - Truths

The Facts About Mileagewise - Reconstructing Mileage Logs Revealed

Table of ContentsMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedThe Single Strategy To Use For Mileagewise - Reconstructing Mileage LogsNot known Factual Statements About Mileagewise - Reconstructing Mileage Logs Mileagewise - Reconstructing Mileage Logs Fundamentals ExplainedThe Greatest Guide To Mileagewise - Reconstructing Mileage LogsGet This Report about Mileagewise - Reconstructing Mileage Logs3 Easy Facts About Mileagewise - Reconstructing Mileage Logs Explained

Timeero's Quickest Distance feature recommends the fastest driving path to your staff members' destination. This attribute enhances performance and adds to set you back financial savings, making it an essential possession for businesses with a mobile labor force. Timeero's Suggested Path function better enhances responsibility and effectiveness. Workers can compare the suggested course with the real route taken.Such a technique to reporting and conformity simplifies the frequently intricate job of taking care of mileage costs. There are several benefits related to utilizing Timeero to track mileage. Allow's take an appearance at several of the app's most notable functions. With a relied on mileage tracking tool, like Timeero there is no requirement to stress over accidentally omitting a date or item of information on timesheets when tax time comes.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

These extra confirmation actions will certainly maintain the Internal revenue service from having a reason to object your mileage records. With precise gas mileage tracking modern technology, your workers don't have to make harsh gas mileage price quotes or even worry concerning gas mileage cost monitoring.

If a worker drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all automobile expenses (free mileage tracker). You will certainly need to continue tracking mileage for job even if you're utilizing the real expenditure method. Keeping mileage records is the only way to different service and individual miles and offer the proof to the internal revenue service

The majority of gas mileage trackers let you log your trips by hand while calculating the distance and reimbursement amounts for you. Numerous likewise featured real-time trip tracking - you require to begin the application at the start of your trip and quit it when you reach your final destination. These applications log your start and end addresses, and time stamps, along with the overall range and compensation quantity.

Some Of Mileagewise - Reconstructing Mileage Logs

This includes expenses such as fuel, maintenance, insurance coverage, and the lorry's depreciation. For these expenses to be thought about deductible, the automobile must be made use of for service purposes.

6 Easy Facts About Mileagewise - Reconstructing Mileage Logs Shown

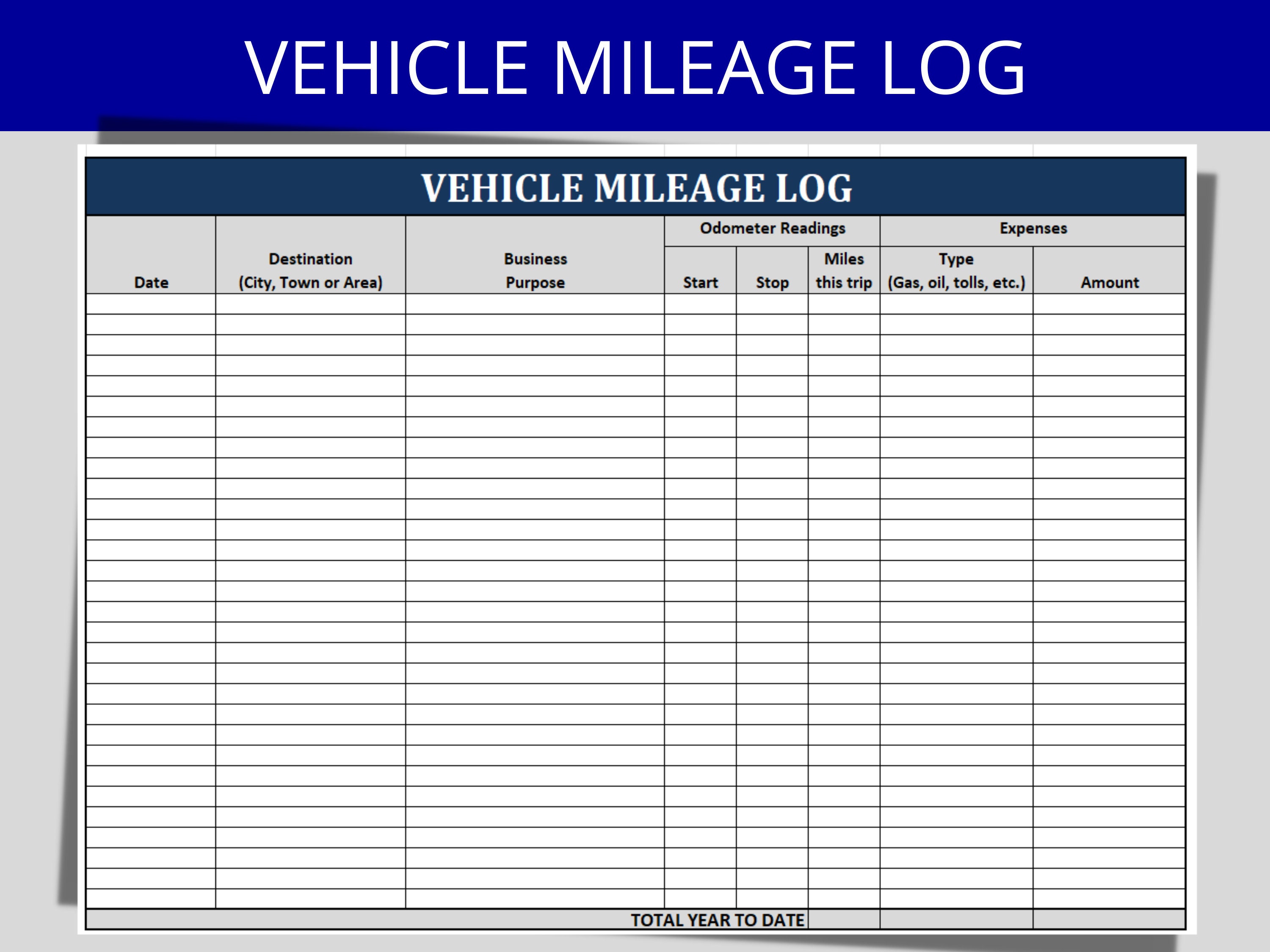

Beginning by tape-recording your vehicle's odometer reading on visit homepage January 1st and after that again at the end of the year. In in between, carefully track all your company trips noting down the beginning and finishing analyses. For each and every trip, record the area and business objective. This can be simplified by maintaining a driving visit your cars and truck.

This consists of the total service mileage and complete mileage build-up for the year (service + personal), journey's date, destination, and function. It's important to tape-record tasks immediately and keep a simultaneous driving log detailing date, miles driven, and business function. Below's how you can boost record-keeping for audit objectives: Start with ensuring a careful mileage log for all business-related travel.

The Facts About Mileagewise - Reconstructing Mileage Logs Revealed

The real expenses method is an alternate to the typical mileage rate technique. Instead of calculating your reduction based upon a predetermined rate per mile, the actual costs technique enables you to subtract the real costs linked with using your vehicle for company functions - mileage tracker app. These prices consist of gas, upkeep, repairs, insurance, devaluation, and other related expenses

Nevertheless, those with significant vehicle-related expenses or unique conditions may gain from the real expenditures approach. Please note electing S-corp standing can transform this computation. Inevitably, your picked technique ought to straighten with your specific monetary objectives and tax scenario. The Requirement Gas Mileage Rate is an action issued annually by the IRS to figure out the insurance deductible costs of running an auto for business.

The Definitive Guide for Mileagewise - Reconstructing Mileage Logs

(https://www.ted.com/profiles/48271352)Compute your total organization miles by utilizing your start and end odometer analyses, and your taped company miles. Accurately tracking your specific mileage for company journeys aids in validating your tax obligation reduction, particularly if you decide for the Requirement Mileage technique.

Maintaining track of your gas mileage manually can call for persistance, however bear in mind, it could save you money on your tax obligations. Record the complete mileage driven.

Mileagewise - Reconstructing Mileage Logs for Dummies

And currently virtually every person utilizes GPS to get about. That indicates nearly everyone can be tracked as they go about their company.